You may have heard of the insurance company Nobleoak. These guys ran some super successful advertising campaigns about 12 months ago.

Nobleoak is a direct insurer - think of them as the Koala Mattress of the Insurance Industry.

By cutting out the middle man (advisers), Nobleoak claims that you will save money on your premiums. According to them, the saving is 20% on average.

In this video, I decided to put these claims to the test and did my very own quote with Nobleoak then compared this to what was available in the market to see if this was true.

Background

Nobleoak has been around for about 140 years and is backed by the Re-Insurer Hannover Life Re. Nobleoak as claimed on their website is Australia's most awarded direct Life Insurer in 2019 and have a swag of other awards.

The reviews for Nobleoak are really good when you look online, at the time of writing this, they have 186 Google Reviews with an average rating of 4.5/5.

The big claim that Nobleoak makes is that by cutting out the middle man (advisers) the premiums will be lower. The difference they claim is 20% lower than insurances that pay commission to advisers.

I decided to get a quote for myself and compare it to the rest of the market to see if these claims were true.

Nobleoak Quoting Process

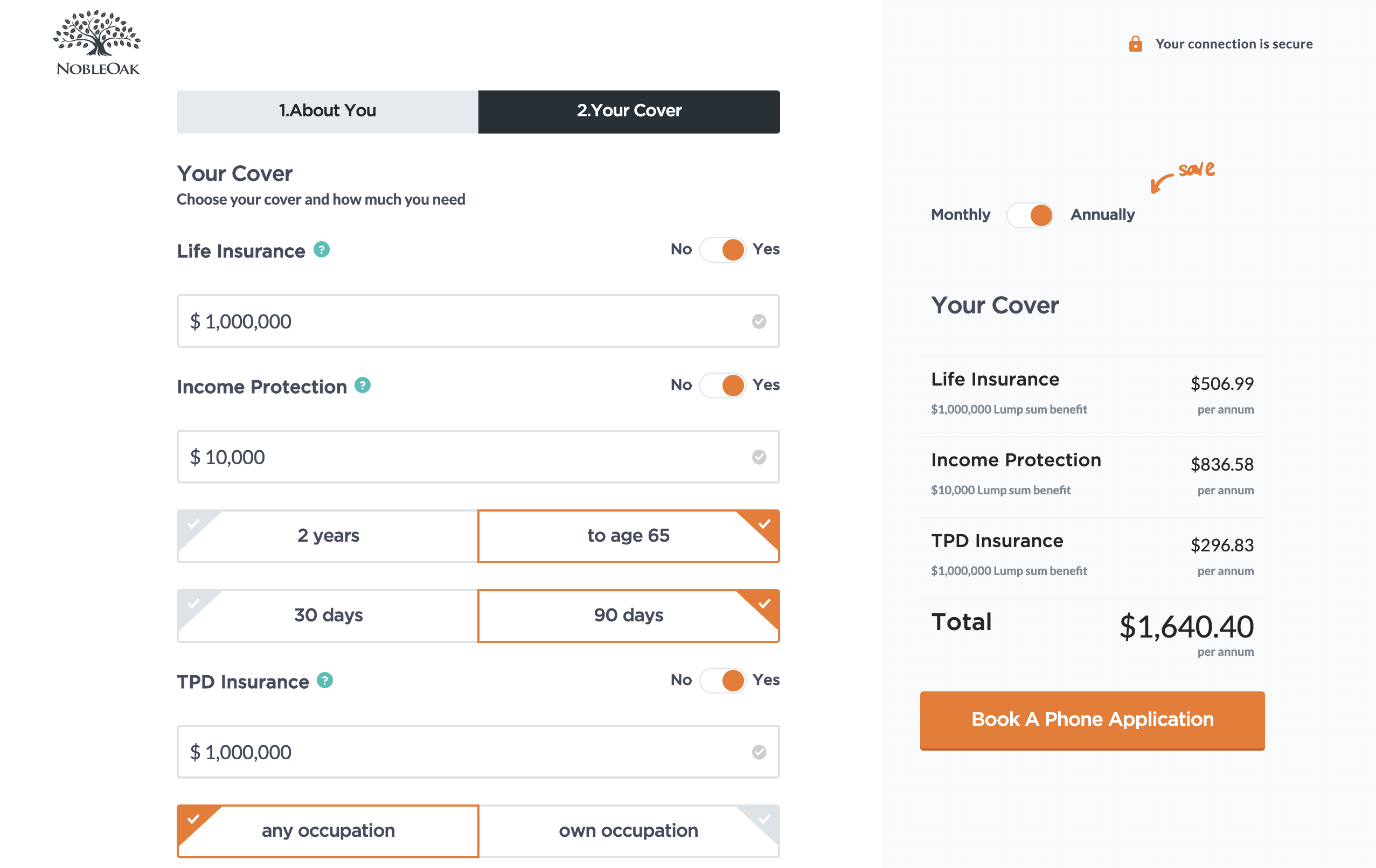

I found the process of getting a quote with Nobleoak to be simple, intuitive, and fast. Entering in my own details and the insurance cover levels that I was after, it only took about 5 minutes to generate a quote for the cover I had requested.

With Nobleoak, this quoting process does require you to know how much insurance you need. They do have their own calculator for helping you work this out, or you could try the one I have built by clicking here (opens on Facebook Messenger).

I quoted a pretty typical insurance package:

- Life Insurance - $1,000,000

- TPD - $1,000,000

- Income Protection - $10,000 pm, 90 Day Wait, to Age 65

Using my own personal information (Age, Income, Occupation), I received the below quote:

The Comparison

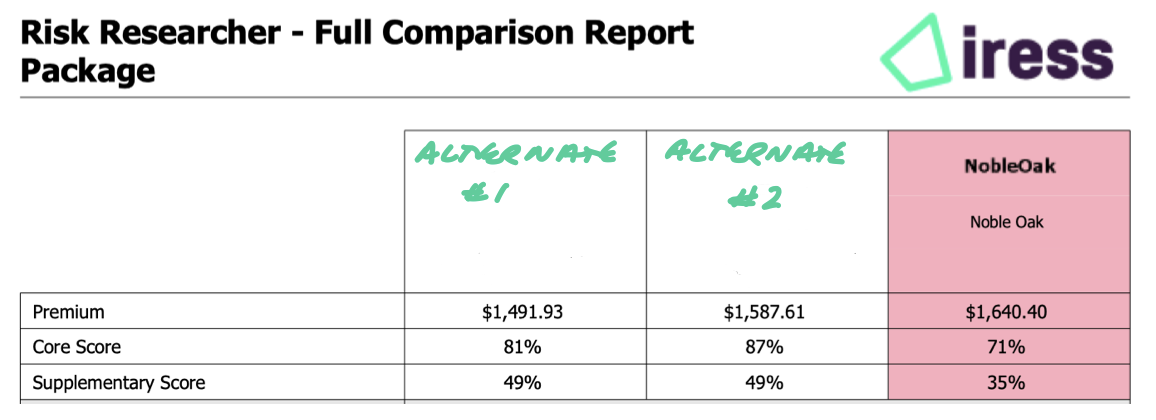

Once I had my quote from Nobleoak, I jumped into my quoting software which relies upon the independent research software IRESS.

This is not something that you will be able to do at home as it relies on having a paid subscription. Later in this blog, I have provided a couple of alternate sites for you to get some comparison quotes. These sites won't allow you to drill down on the features/benefits of each policy but will at least give you a pricing comparison.

The way this software works is that each of the providers is ranked based on the underlying features of their policies. They are each then given a score out of 100 with the higher the ranking, the better the quality of the products.

Here are the results from my Nobleoak quote versus what could be offered in the market:

As you can see from the above report, when I compared the quote from Nobleoak to the same level of cover with the market, I was able to get a better quality product for less.

My Conclusion

Whilst the result for me suggested that Nobleoak would not be the best option, I am sure there would be scenarios that it would be cheaper for you to go directly to them when compared to what you can obtain from the rest of the market.

I do believe that direct insurers have a place in the market and they do offer a good solution for you if you know:

- Exactly how much cover you need

- How you would like this structured (super vs non-super)

- You only required stepped premiums

My hope from this article is that no matter which way you go that you do some additional research.

Whilst you won't have a paid subscription to the research software (I'd hope haha), you could try a couple of other websites to see how the quote from Nobleoak would compare with others.

Two other sites you could try are Lifebroker (NB these guys are owned by the insurance company TAL) or Finder.

Completing this step will allow you to compare from a pricing perspective how the Nobleoak quote stacks up against these other providers, the same way you would if you were shopping for anything else.

Stop wasting money on premiums!

Download my free guide to avoid the 29 most common mistakes people make with their insurance.

Download Here